Sooner or later, every landlord needs it.

Here’s the ins and outs of landlord insurance (and why you need it).

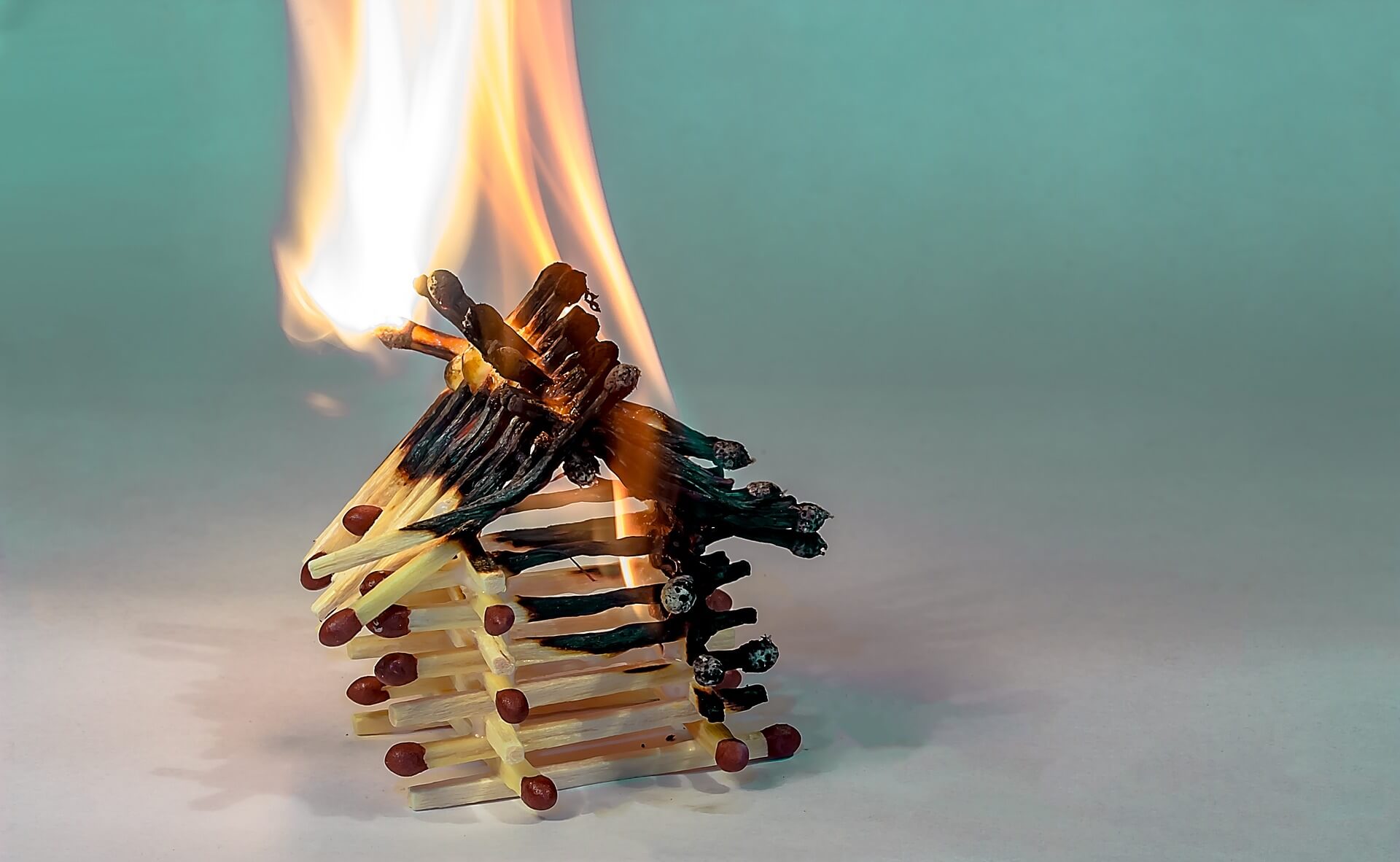

As a landlord, you know that your rental properties are exposed to a wide range of risks, from average wear and tear to flat-out vandalism. How do you protect this valuable asset?

The answer: landlord insurance.

When disaster strikes, the right insurance policy can be the difference between bankruptcy and true financial recovery. So let’s take a closer look at the types of coverage available to protect your rental properties, your tenants, and your wallet.

What Is Landlord Insurance?

Many new landlords are confused about insurance when they first consider it. Is it home insurance? A type of business insurance?

In reality, landlord insurance lies somewhere between the two.

There is no specific insurance policy termed “landlord insurance.” This term is typically used to refer to the network of coverage you need if you are renting out a home, attachment, or unit.

There are a number of different kinds of landlord insurance. The kind and amount you want will all depend on what kind of unit you are renting.

If you are one of the millions of Americans renting a room in your home or an attachment to your home, you can get landlord insurance as a rider on your existing homeowners’ policy. If you are renting a house or an apartment in a building that you own but do not live in, you will need a separate network of policies.

If your rental unit or units exist in an area with a homeowner’s association, you should also research ways to get residents to follow rules of your homeowner’s association.

What Does Landlord Insurance Cover?

Landlord insurance is often referred to as “rental insurance” or “rental policy insurance” but it should not be confused with renter’s insurance.

Renter’s insurance is paid for by your tenants and covers their personal belongings against loss, theft, or damage. Landlord insurance covers your belongings (i.e. the physical structure of the house).

There may be occasions when the two forms of coverage overlap. For example, if a car barreled through the wall of the living room, the collapsed roof and walls would fall under the landlord’s insurance policy and the demolished couch and TV would be covered by renter’s insurance.

Landlord Insurance Policies

You might be used to homeowners insurance, which covers your personal belongings as well as the structure of the home (that you also own). But if you’re a landlord, this doesn’t exactly apply to your situation.

As we mentioned earlier, there’s no single policy labeled “landlord insurance.” Instead, there are separate landlord insurance policies for almost any legal or financial problem you might face.

Here are some of the most common (and useful) insurance policies for landlords.

Dwelling Coverage

Dwelling coverage is basically “property insurance” for landlords, but applies only to the physical structure of the rental home.

Property damage coverage is the bare minimum of insurance coverage you need as a landlord and covers the dwelling itself, detached structures (such as sheds and fences), and any personal items you might use to maintain the address (such as a lawnmower).

Liability Coverage

Liability coverage pays for medical care and/or legal fees in the event that someone is injured on the property and accuses you of negligence.

For example, let’s say your tenant (or a guest) falls off the back deck and claims that the railing was faulty. If a judge agrees with them, liability insurance would cover their medical bills as well as your legal fees for the resulting lawsuit.

Loss of Income Coverage

You likely became a landlord because of the passive rental income. But what happens if that income stops?

Loss of income coverage steps in when you are unable to rent out your property or unit. Typically, these policies apply to houses affected by natural disasters, but you can find similar policies that cover you if you need to take a property off the market to renovate it.

Rent Guarantee Insurance

While loss of income coverage steps in when your home is uninhabitable, rent guarantee insurance is designed to reimburse you when a tenant doesn’t pay their rent.

When you rely on rent checks to pay your mortgage and insurance premiums, it can be devastating when a tenant is late on their rent or doesn’t pay it at all.

Flood Insurance

Floods are a significant risk in Florida, but they are not included under standard insurance policies in Florida—not even if they’re caused by a hurricane.

Even if your rental property doesn’t lie in a flood plain, you should not be without some form of flood coverage.

Invest In Your Future

When you own a rental property, you don’t just own a home, you own a business. And landlord insurance is the best way to protect your assets against the numerous risks they face.

Yet more often, you’ll find yourself up against a problem that no insurance company can solve. That’s where a good property management company can step in.

At American Home Team Realty, we specialize in making your passive income truly “hands off.” From rent collection to maintenance requests, we provide 24/7 customer service to landlords and their tenants.

Call today to see how we can help you.